Increase operational efficiencies

Confidence in your waterfall calculations, transaction activity, and compliance reporting is vital when making strategic business and investment decisions. Siepe delivers access to accurate data with full transparency to help you streamline workflows while increasing portfolio oversight and efficiency.

Trade Processing

Waterfall Calculations & Distributions

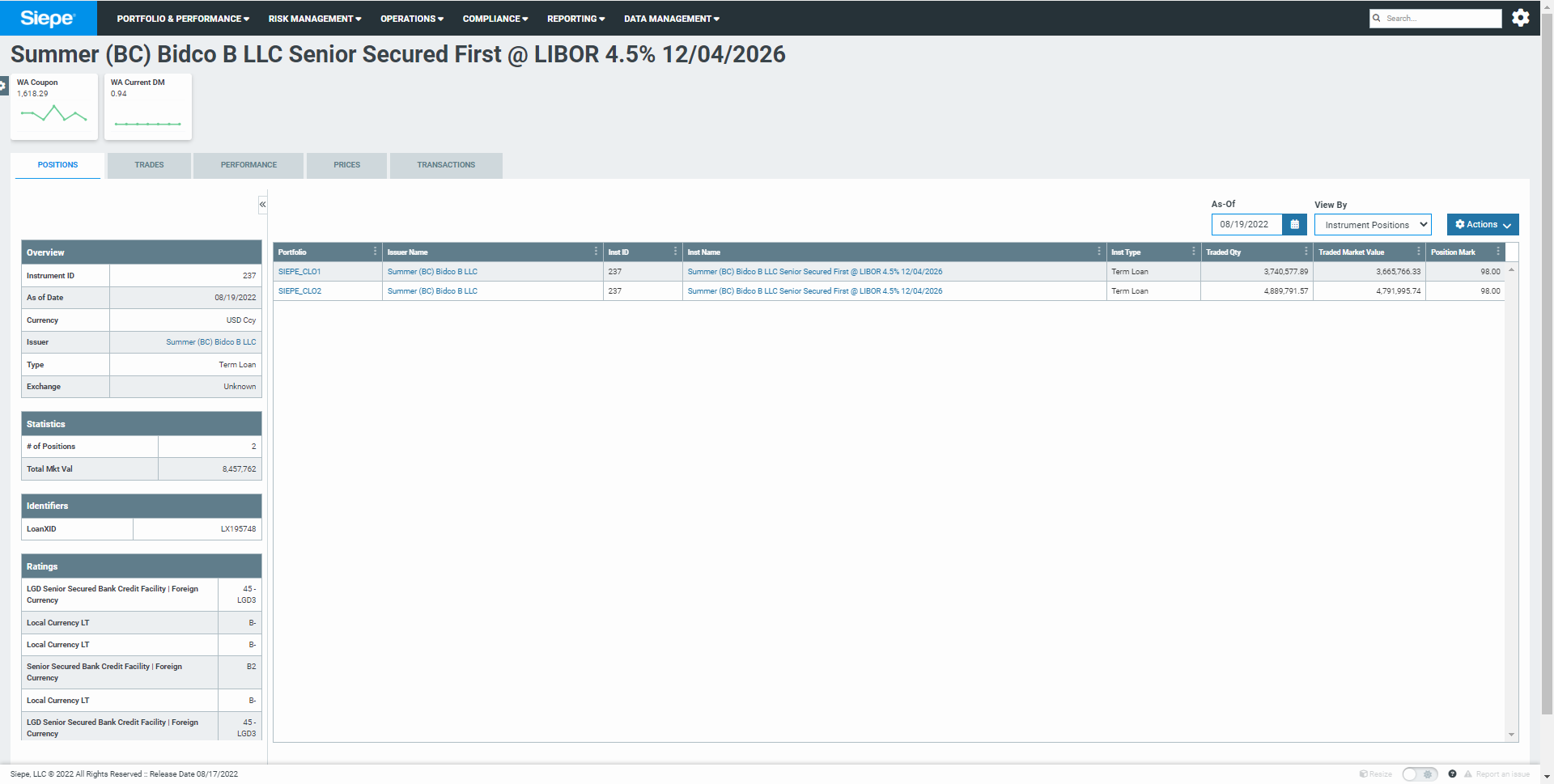

Portfolio Tracking & Administration

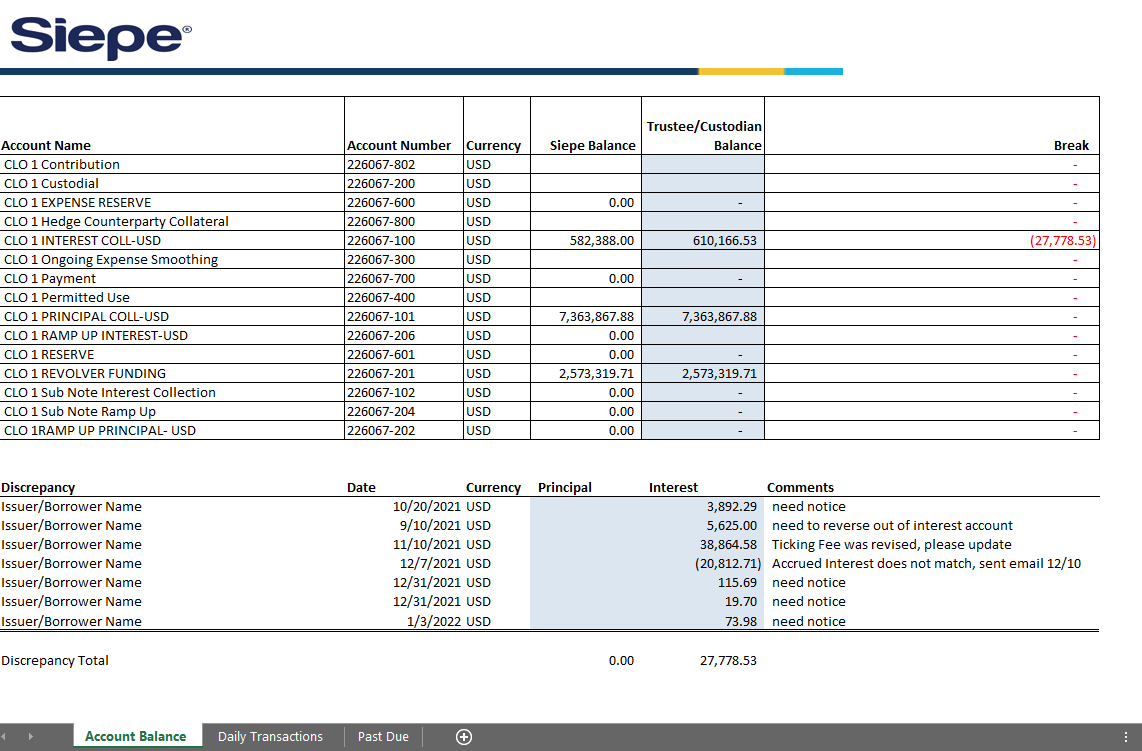

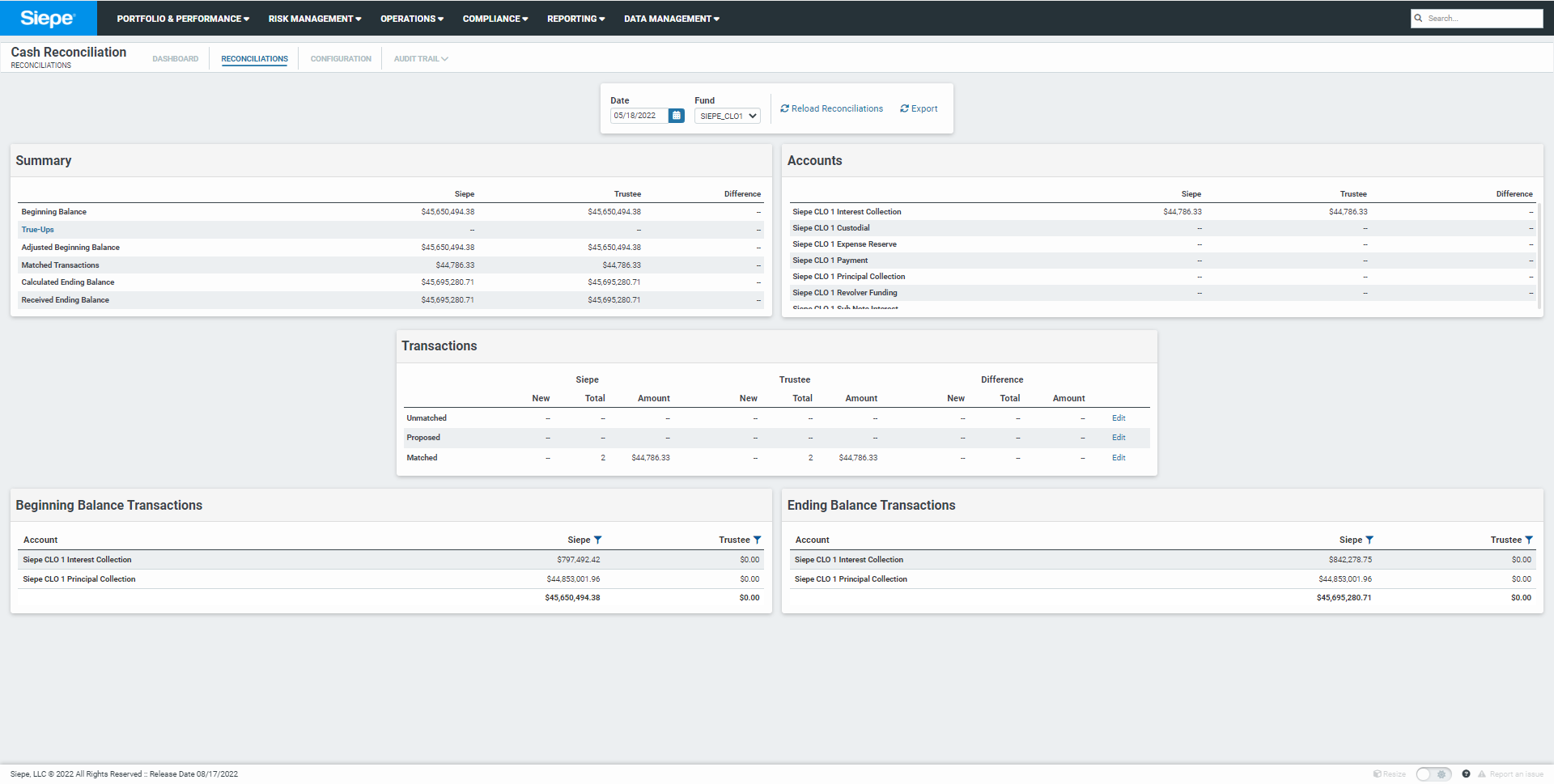

Cash Reconciliation – Forecasted vs Actual

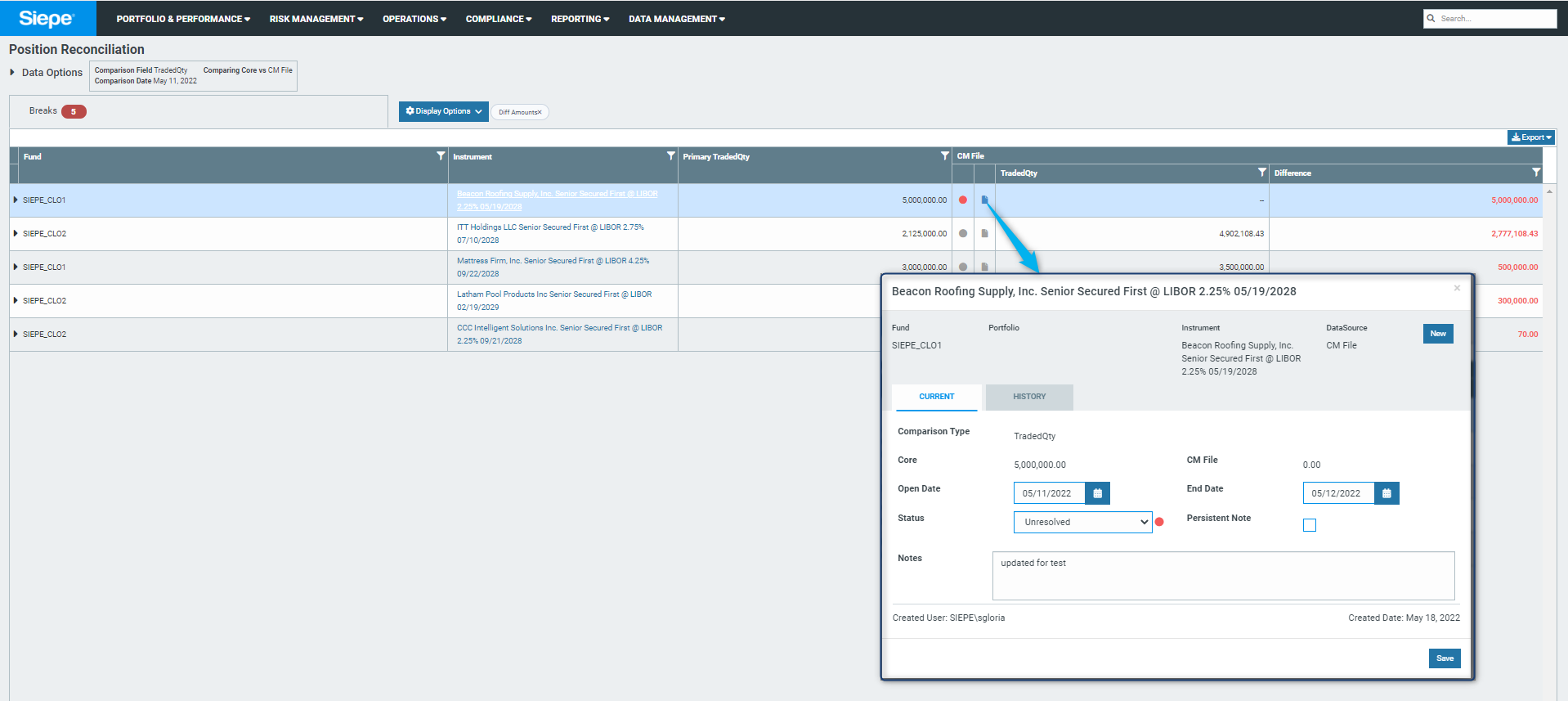

Position & Data Attribution Reconciliation

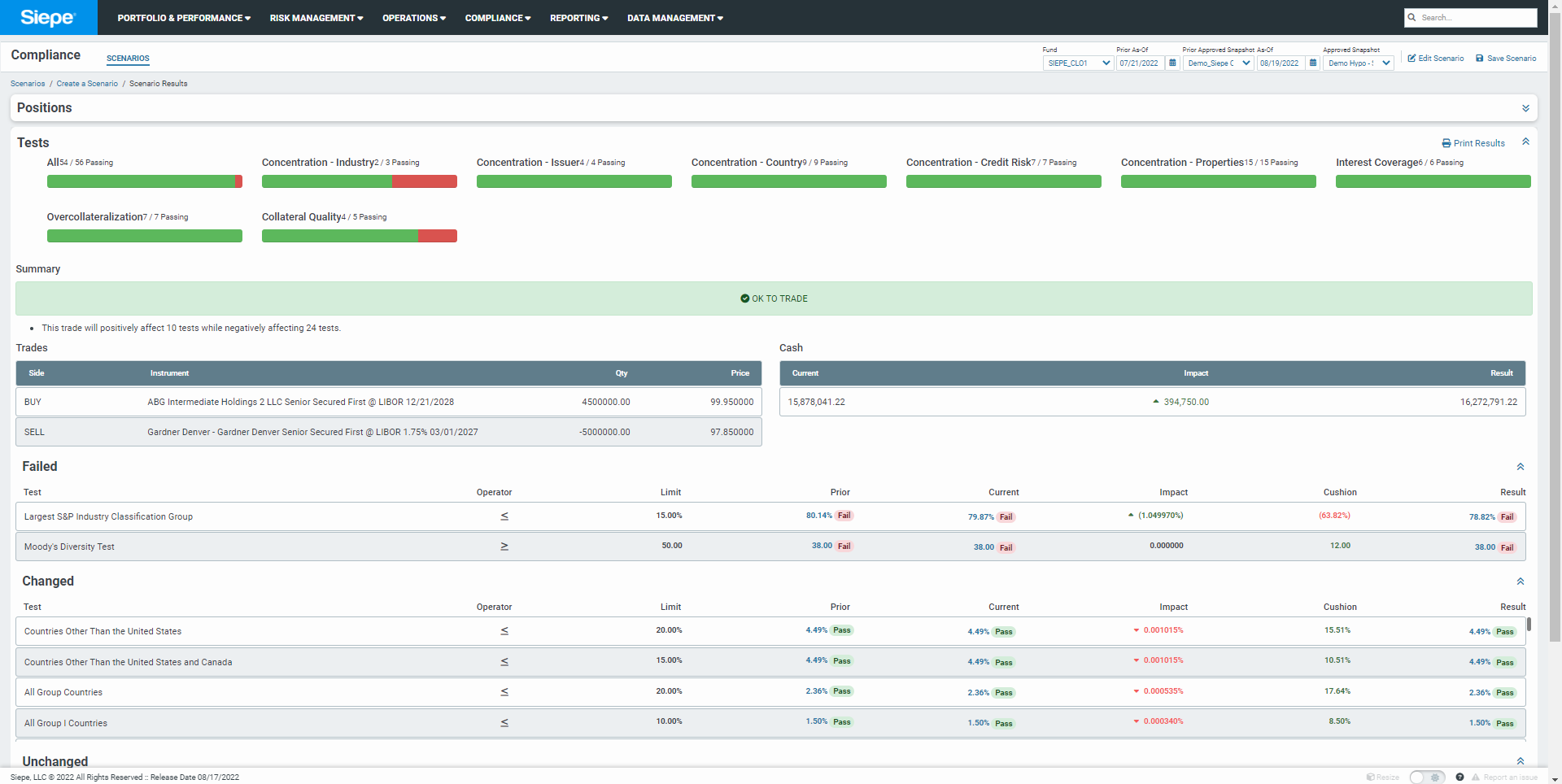

Daily, Monthly, & Quarterly Compliance Reporting

THE SIEPE DIFFERENCE

BEST-IN-CLASS

Comparative advantage with top-tier trust/custody bank fully integrated with a specialized, tech-enabled administrator

QUALITY

Data integrity, client service responsiveness, and flexible reporting are the hallmarks of our offering

TRANSPARENCY

Daily reconciliation of cash, par and attributes and custom delivery of data files tailored to your needs

EXPERT STAFF

Additional layer of trustee client service staff with requisite experience and access to deal-level data

AUTOMATION

Electronic integration of trade ingestion, cash matching, money movements, redemptions, payments and settlements

TECHNOLOGY

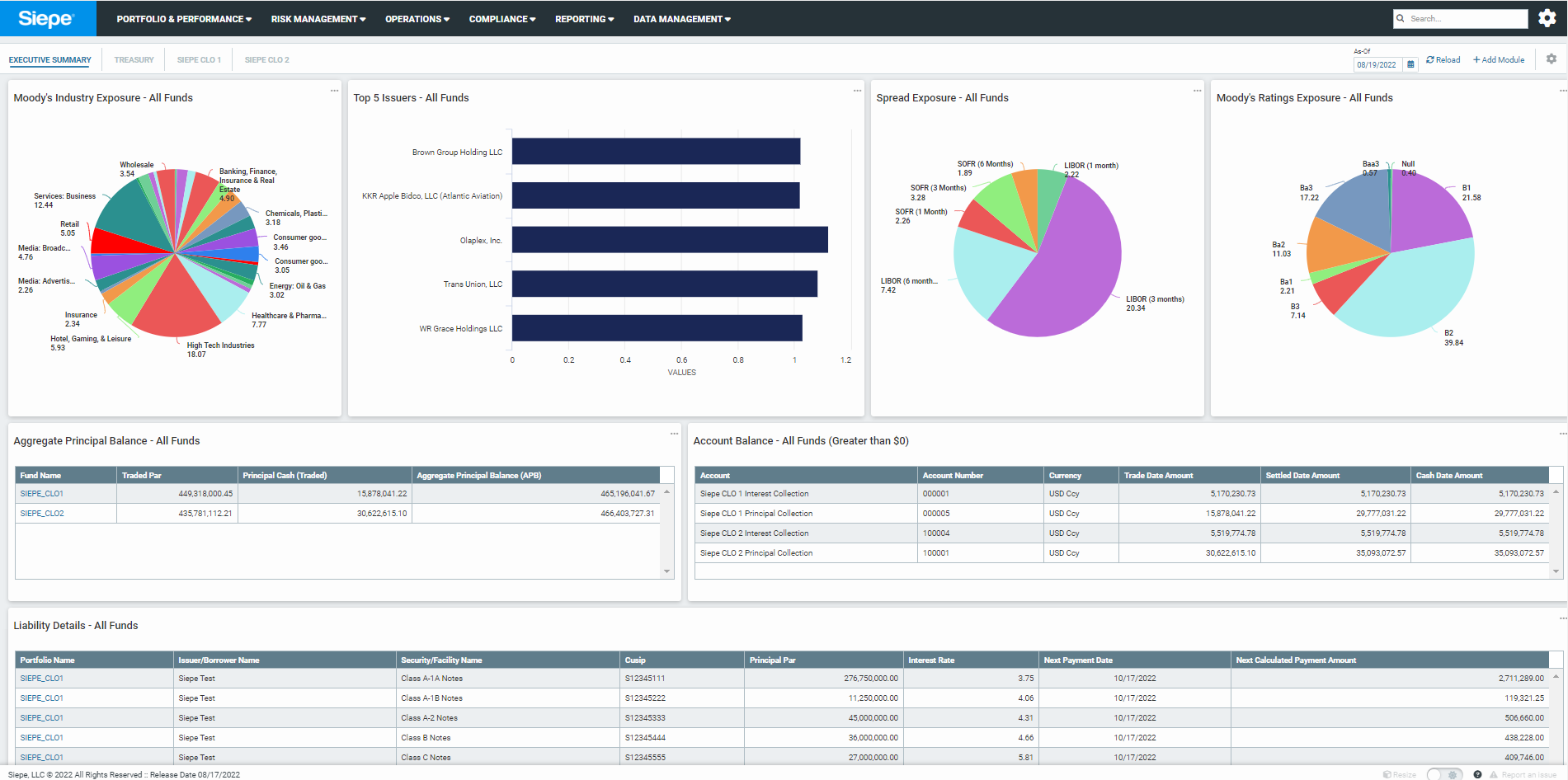

Client Portal provides direct access to portfolios, cash, par, compliance results and thresholds with customized layouts

SERVICE TEAM MODEL

CLIENT SERVICES

- Documentation review and collaboration with deal parties, and warehouse/CLO/account closing

- Account onboarding/opening and management across entire transaction life-cycle

- Internal and external deal parties to meet governing requirements

- Coordinate with Trustee for transaction creation

- Design and implementation of quality control metrics and performance targets

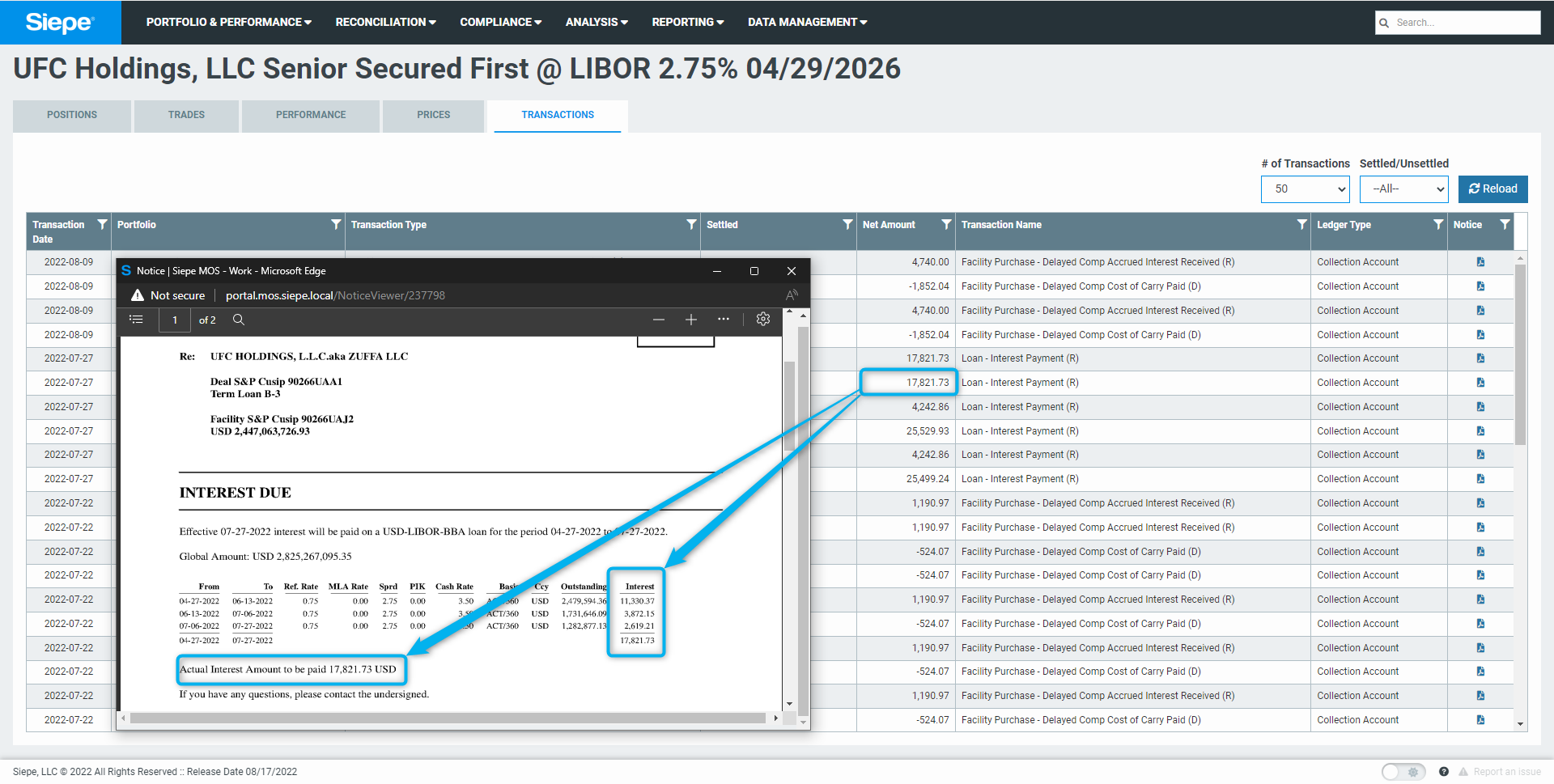

ASSET ADMINISTRATION

- Day-to-day administration and tracking of transaction portfolio for interpreting and processing agent bank notices, credit agreements, and other governing documents

- Oversight of automated processes and agent bank notifications

- Daily data integrity validation and exception reporting, break investigation and resolution, circulates required daily reporting to clients

- Maintain or surpass internal quality control metrics and performance targets

TECHNOLOGY TEAM

- Development of client-facing reports based on client requests

- Collaboration with business stakeholders and 3rd parties to support business processes

- Identification of repetitive problems and develop permanent solutions

- Troubleshoot problems loading data from automated data feeds

- Work collaboratively with internal and external stakeholders

ANALYTICS & INVESTOR REPORTING

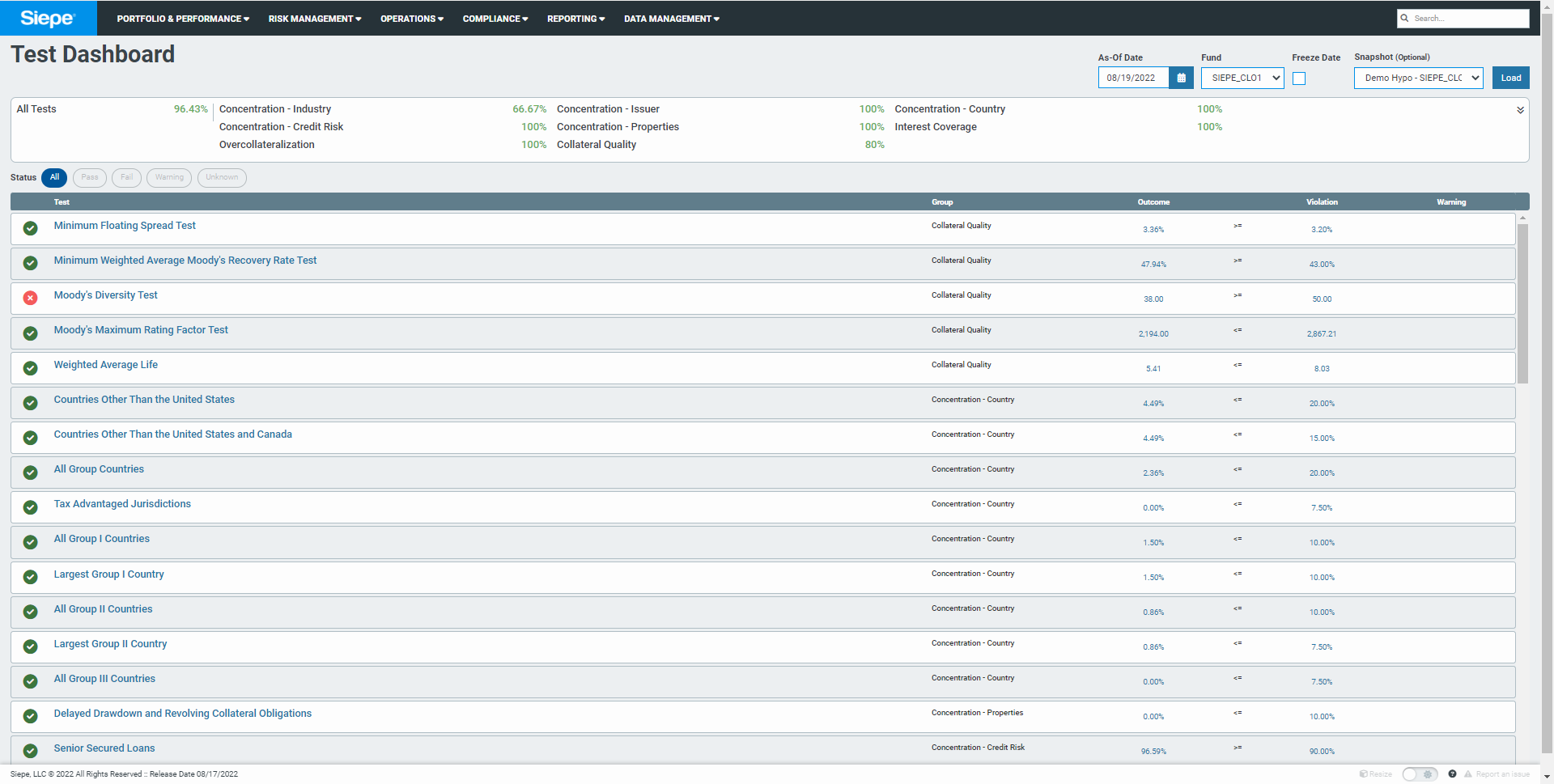

- Knowledge and understanding of various portfolio structures, compliance testing and required reporting

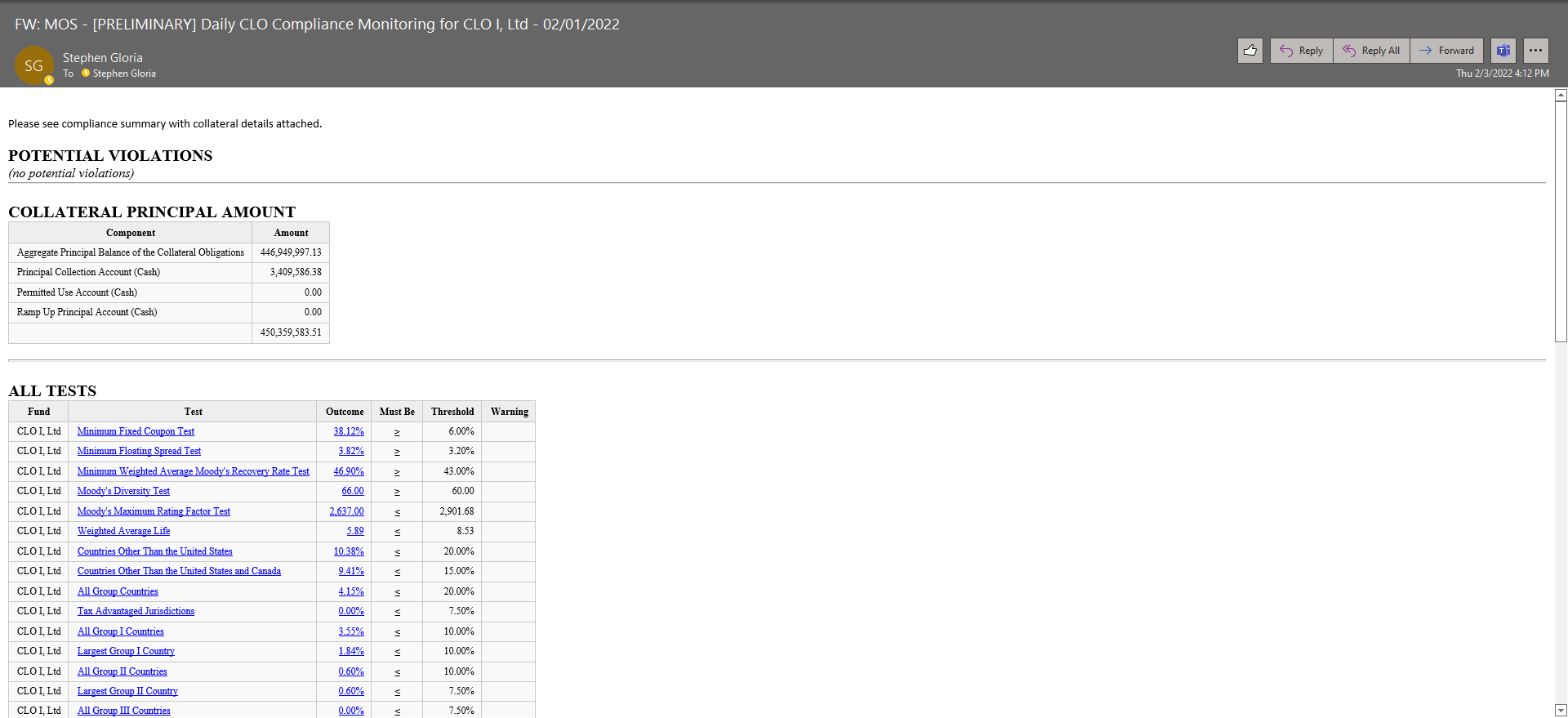

- Generate monthly and quarterly reporting with quarterly waterfall calculations

- Collaborate with Asset Administration Team for daily/monthly/quarterly cash and position reconciliation, manage reconciliations with Collateral Managers, and ensure data integrity

- Manage processes and deliverables and maintain internal quality control metrics and performance targets

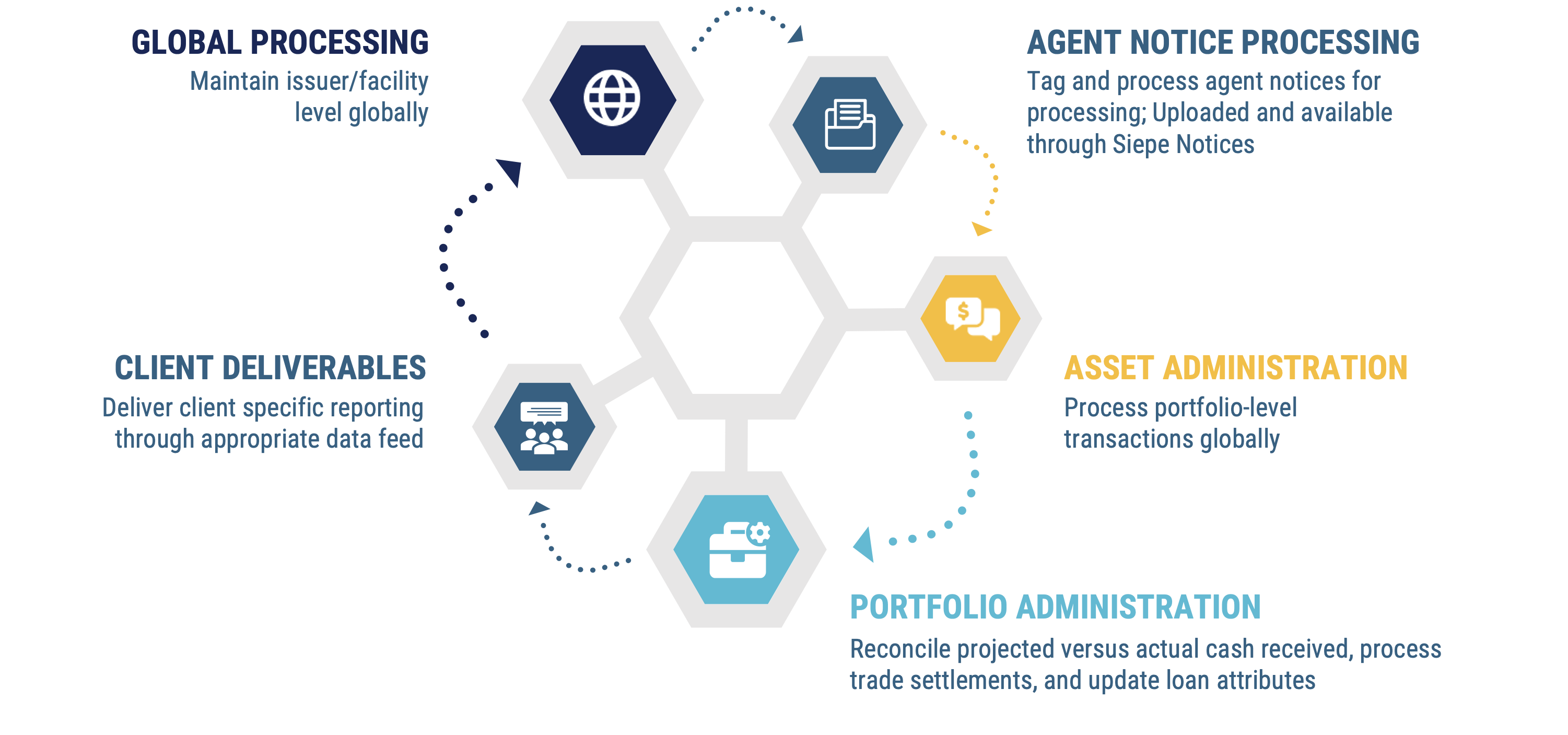

SERVICES BY LOAN CYCLE

WAREHOUSE/CLOSING

- Compliance (if applicable)

- Par & Attribute Recons

- Cash Recons

- Flow of Fund (FOF) reconciliation

- Tie-outs 2 BD Prior to close

DAILY

- Cash Reconciliation

- Actual & Projected

- Position Reconciliation

- Traded & Settled

- Compliance Reporting

MONTHLY

- Compliance Report Generation

- Collateral Manager Reconciliation

- Cash

- Positions

- Attributes

- Test Results

QUARTERLY

- Waterfall Payment Calculation

- Collateral Manager Reconciliation

- Quarterly Report Generation

- Cash distribution calculations

- Waterfall and payment allocation

CASH AND POSITION RECONCILIATION PROCESS

Collateral Administration Add-On Modules

Third-Party Data Management

Multi-Fund Pre-Trade Compliance

Performance Attribution & Benchmarking

Expense Tracking & Allocations

Financial Statements

Interested in learning more?

Download the product sheet for more information.

"*" indicates required fields